China Electric Vehicle Market, (By Product Type: BEV, PHEV & Others. By Vehicle: Passenger Cars Commercial Vehicles & Others. By Region - China) - Industry Analysis, Growth, Trends & Forecast, 2022 to 2032

Report Type : Syndicate Report

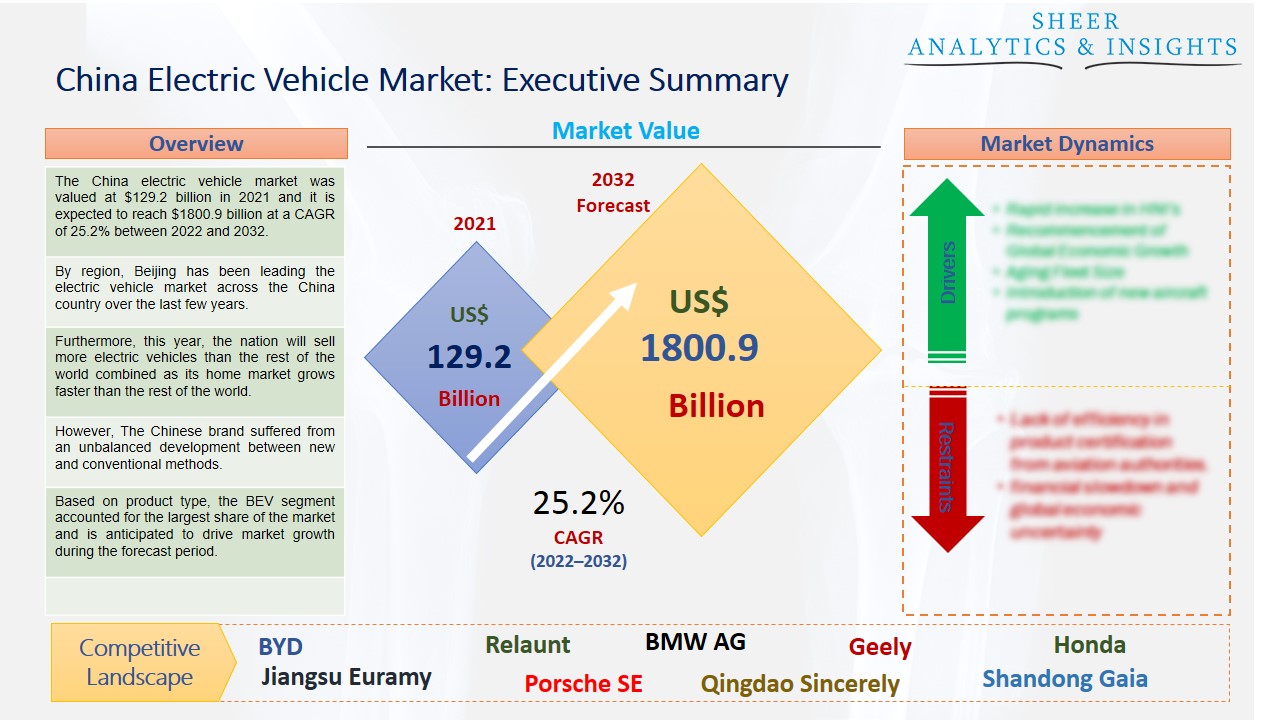

The China electric vehicle market was valued at $129.2 billion in 2021 and it is expected to reach $1800.9 billion at a CAGR of 25.2% between 2022 and 2032. This year, the nation will sell more electric vehicles than the rest of the world combined as its home market grows faster than the rest of the world. Additionally, this year, an all-electric car or a plug-in hybrid will make up 25% of all new automobiles bought in China. More than 300 Chinese businesses, according to some estimates, produce electric vehicles.

By region, Beijing has been leading the electric vehicle market across the China country over the last few years.

Because they have fewer moving parts to repair and consume little to no fossil fuels, electric vehicles are very economical to operate. While some EVs employed lead acid or nickel metal hydride batteries, lithium-ion batteries are now thought to be the industry standard for contemporary battery electric vehicles because of their superior energy retention and longer lifespan. In addition, BEVs may be charged overnight at home, giving them enough range for routine commutes. Although regenerative braking or traveling downhill can help reduce this by charging the battery packs, longer or more difficult trips may need charging the fuel cells before you arrive at your destination. China has experienced fast growth in the electric car industry as a result of government incentives, burgeoning manufacturing firms, and expanding charging infrastructure. The world's largest and fastest-growing EV market is in China, where 2.4 million EVs have been delivered to customers.

Source: SAI Research

Download Free PDF Sample Request

Furthermore, this year, the nation will sell more electric vehicles than the rest of the world combined as its home market grows faster than the rest of the world. Chinese retiree Zhang Youping bought an all-electric compact sport utility vehicle from BYD, China's leading manufacturer of electric vehicles, during an auto exhibition. While other markets for electric vehicles still rely significantly on financial incentives and subsidies, China has entered a new stage in which consumers are comparing the benefits and costs of electric vehicles versus gas-powered cars without giving any thought to government assistance. The United States has a huge gap. The nation reached a significant milestone this year when E.V. sales reached 5% of new automobile sales.

However, The Chinese brand suffered from an unbalanced development between new and conventional methods. It consequently decided to integrate the traditional paradigm with digital innovation. It changed the employment structure by substituting workers from the automobile sector for managers and lower-level workers. To create the image of high-tech and premium automobiles, NIO also studied the marketing and pricing tactics of international luxury companies like Mercedes-Benz, BMW, and Audio. NIO was able to adapt to the new Chinese consumer preferences, which are focused on high-tech vehicles, thanks to the new transformation.

Based on product type, the BEV segment accounted for the largest share of the market and is anticipated to drive market growth during the forecast period. Local OEMs have long dominated the battery-electric vehicle (BEV) industry in China, the largest in the world, with an 85 percent market share in 2019. But that might alter shortly. Due to the market's potential, foreign OEMs entered the Chinese market in 2020 and are now actively seeking an advantage over local competitors. With models like the Toyota Corolla Hybrid and Honda Accord Hybrid, automakers like Toyota and Honda have dominated the hybrid vehicle market in China.

In terms of vehicle type, the passenger cars segment has led the market over the past few years and is also expected to propel market growth in the future. The greatest supply of plug-in passenger vehicles on public roads is in China. China also controls the deployment of electric buses and plug-in light commercial vehicles. Additionally, the nation is the market leader for the selling of battery-powered medium- and heavy-duty electric trucks. Since a few years ago, China has consistently sold the most plug-in electric passenger cars worldwide. However, many major Chinese cities impose driving bans on passenger cars on specific days based on the license plate number, but these do not apply to electric vehicles.

Based on regions, the market is segmented into Beijing, Tianjin, Shanghai, Zhejiang, and others. Among these provinces, Beijing holds most of the market share and is also expected to hold its dominant position during the forecast period. Most of the manufacturing companies are established in this location which is another plus point for the China electric vehicle market. To encourage its citizens to transition to electric vehicles, Beijing only gives 10,000 permits per month for the registration of combustion-engine automobiles. Several towns, notably Beijing and Shenzhen, have declared that they will convert their entire taxi fleets to electric cars within a few years.

According to the study, key players such as BMW Group (Germany), BYD (China), Groupe Relaunt (Japan), Geely (China), Honda (Japan), Jiangsu Euramy (China), Porsche SE (Germany), Qingdao Sincerely (China), Shandong Gaia (China), SAIC MOTOR (China), The Hero Group (India), Tata Group (India), Tesla Inc (U.S), Yamaha (Japan), among others are leading the China electric vehicle market.

Scope of the Report:

| Report Coverage | Details |

| Market Size in 2021 | US$ 129.2 Billion |

| Market Volume Projection by 2032 | US$ 1800.9 Billion |

| Forecast Period 2022 to 2032 CAGR | 25.2% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Product Type: BEV, PHEV & Others By Vehicle Type: Passenger Cars Commercial Vehicles & Others |

| Geographies covered |

China |

| Companies covered | BMW Group (Germany), BYD (China), Groupe Relaunt (Japan), Geely (China), Honda (Japan), Jiangsu Euramy (China), Porsche SE (Germany), Qingdao Sincerely (China), Shandong Gaia (China), SAIC MOTOR (China), The Hero Group (India), Tata Group (India), Tesla Inc (U.S), Yamaha (Japan), among others. |

The China Electric Vehicle Market Has Been Segmented Into:

The China Electric Vehicle Market – by Product Type:

- BEV

- PHEV

- Others

The China Electric Vehicle Market – by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Others

The China Electric Vehicle Market – by Regions:

- China

- Beijing

- Tianjin

- Shanghai

- Zhejiang

- Others

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing