Latin America Cashfree Payments Market, (By Payment Type: Digital Currencies, Bank Cards, Digital Wallets, Net Banking, Points of Sales & Others. By Enterprise Type: Small and Medium Enterprises, Large Enterprises. By End-User Type: BFSI, Healthcare, Media and Entertainment, Retail and E-Commerce, Transportation & Others. By Region – Latin America | 2022-2032

Report Type : Syndicate Report

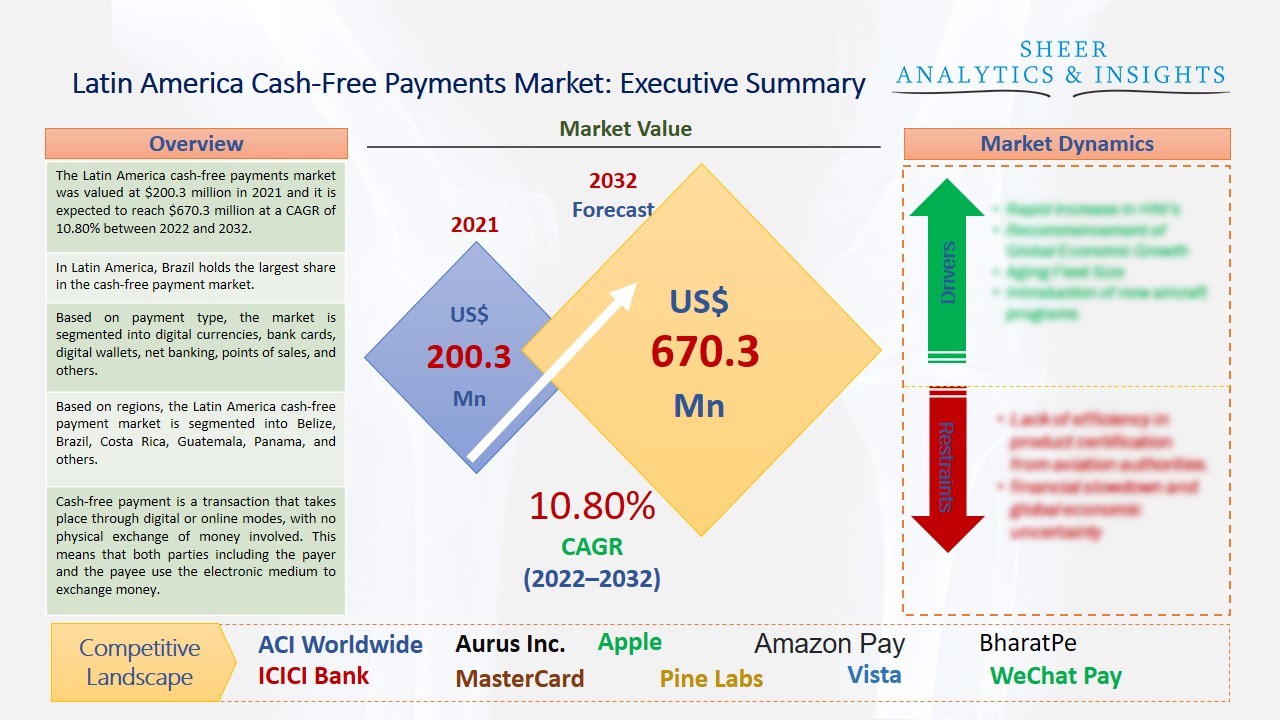

The Latin America cash-free payments market was valued at $200.3 million in 2021 and it is expected to reach $670.3 million at a CAGR of 10.80% between 2022 and 2032. Cash-free payment is a digital payment platform, through which consumers make transactions. They receive payments and transfer money to others' bank accounts. This payment method has become easy to use for people.

In Latin America, Brazil holds the largest share in the cash-free payment market.

In the last two years, consumers of Latin America opted for smartphones when shopping online, with such usage, the market has witnessed significant growth. However, in Latin America, Central banks and other public authorities have recently launched important initiatives to improve national payment systems, which complement developments in the private sector. In last couple of years, Latin America has seen a huge rise in the number of financial technology firms that has offered several convenient ways to pay, and big technological firms have begun to integrate payment services into their e-commerce platforms. Moreover, after the COVID-19 situation, people have become more concerned about using cash-free payment methods through various online applications using smartphones. Additionally, wider use of the internet and mobile phones and the large margins earned by PSPs, have made Latin America an attractive market for new farms and the adoption of innovative and more convenient payment methods. Moreover, the rising number of mobile sales and new payment application usage has further driven the cash-free payment market over the last few years. It is also expected to fuel the market across Latin America.

Source: SAI Research

Based on payment type, the market is segmented into digital currencies, bank cards, digital wallets, net banking, points of sales, and others. Digital wallets and net banking held the largest market share in the last couple of years in Latin America. Due to the rising usage of mobile phones and cash-free payment platforms, these segments are estimated to boost the market. Based on the enterprise, the cash-free payment market is categorized into small, medium, and large enterprises. Large enterprises are accounted for significant market growth due to the increasing sales of e-commerce businesses and other online shopping platforms. Based on end-user, the Latin America cash-free payment market is segmented into BFSI, healthcare, media and entertainment, retail and e-commerce, transportation, and others. Among these, the BFSI category holds the maximum share and this segment have supported the growth of the cash-free market in the last few years. Due to the increasing number of bank facilities through digital platforms and transaction systems, consumers of Latin America benefitted from online payment. Therefore, this way the cash-free market of Latin America is estimated to witness significant growth in upcoming years.

Based on regions, the Latin America cash-free payment market is segmented into Belize, Brazil, Costa Rica, Guatemala, Panama, and others. Among these countries, Brazil holds the largest market share of cash-free payments. Merchants in Brazil use various online platforms or payment applications to make secure transactions. Customers from this country have started to use cash-free payment applications to purchase various essential things for their daily usage. Brazil is one of the major financial institutions which help various customers across the country to use an online payment method to make easy national and international transactions. People are using debit and credit cards, mobile payment applications, and banking websites for a person to person and person to business payments. Major mobile carriers across the country have entered into partnerships with financial firms for offering mobile payment solutions. Therefore, digital payment has gone viral in Brazil, which is projected to fuel the growth of the cash-free payment market during the forecast period from 2022 to 2032.

Walmart and Hazel Venture together have launched financial service applications businesses, targeting workers and consumers. PayPal launched the ability to buy, hold and sell cryptocurrency. Through this, customers can choose four types of cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. By accessing their PayPal accounts through the website or the mobile applications, they can view real-time crypto prices, access educational content to help answer commonly asked questions, and learn more about cryptocurrencies, including the opportunities and risks. Bexs Banco and Thunes together have enabled real-time businesses and customers' inbound payments in Brazil. This increased facilities that enable various businesses and wide number of consumers to conduct cross-border transactions. Last year, Visa Inc launched crypto advisory services for financial institutions and merchants, as the adoption of digital currencies gain stream. These services includes that teach cryptocurrency, allow clients to use the payment network for digital offerings, and assist in conducting backend operations. Walmart Inc and Amazon.Com Inc together have invested in contactless payment technologies to benefit more consumers with cash-free options. Therefore, these new launches are estimated to boost the growth of the cash-free payment market in the upcoming years.

According to the study, key players such as ACI Worldwide (U.S), Aurus Inc (India), Apple Inc (U.S), Alphabet Inc (U.S), Amazon Pay (U.S), Adyen (Netherlands), Alipay (China), BillDesk (India), BharatPe (India), Global Payments Inc (U.S), ICICI Bank (India), Instamojo (India), MasterCard (U.S), Novatti Group (Australia), One97 Communications (India), PayPal Holdings Inc (U.S), Pine Labs (India), RazorPay (India), Stripe (U.S), Sage Pay Europe Limited (U.K), Vista Equity Partners (U.S), Visa Inc (U.S), WeChat Pay (China), WEX Inc (U.S), Walmart (U.S), among others are leading the Latin America cash-free payments market.

Scope of the Report:

|

Report Coverage |

Details |

| Market Size in 2021 | US$ 200.3 million |

| Market Volume Projection by 2032 | US$ 670.3 million |

| Forecast Period 2022 to 2032 CAGR | 10.80% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Payment Type: Digital Currencies, Bank Cards, Digital Wallets, Net Banking, Points of Sales & Others By Enterprise Type: Small and Medium Enterprises, Large Enterprises By End-User Type: BFSI, Healthcare, Media and Entertainment, Retail and E-Commerce, Transportation & Others |

| Geographies covered |

Latin America: Belize, Brazil, Costa Rica, Guatemala, Panama & Others |

| Companies covered | ACI Worldwide (U.S), Aurus Inc (India), Apple Inc (India), Alphabet Inc (U.S), Amazon Pay (U.S), Adyen (Netherlands), Alipay (China), BillDesk (India), BharatPe (India), Global Payments Inc (U.S), Huawei Investment and Holdings (China), ICICI Bank (India), Instamojo (India), JD.Com (China), MasterCard (U.S), Novatti Group (Australia), One97 Communications (India), PayPal Holdings (Inc), Pine Labs (India), RazorPay (India), Stripe (U.S), Sage Pay Europe Limited (U.K), UnionPay (China), Vista Equity Partners (U.S), Visa Inc (U.S), WeChat Pay (China), WEX Inc (U.S), Walmart (U.S), among others |

Latin America Cashfree Payments Market Has Been Segmented Into:

Latin America Cashfree Payments Market – by Payment Type:

- Digital Currencies

- Bank Cards

- Digital Wallets

- Net Banking

- Points of Sales

- Others

Latin America Cashfree Payments Market – by Enterprise Type:

- Small and Medium Enterprises

- Large Enterprises

Latin America Cashfree Payments Market – by End-User Type:

- BFSI

- Healthcare

- Media and Entertainment

- Retail and E-Commerce

- Transportation

- Others

Latin America Cashfree Payments Market – by Regions:

Latin America

- Belize

- Brazil

- Costa Rica

- Guatemala

- Panama

- Others

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing