Neo and Challenger Bank Market, (By Services - Loans, Mobile Banking, Checking and Savings Account, Payment and Money Transfer & Others. By End-User - Personal, Business. By Region - North America, Europe, Asia Pacific, and LAMEA) - Global Industry Insights, Market Analysis, Trends, and Forecast 2022-2032

Report Type : Syndicate Report

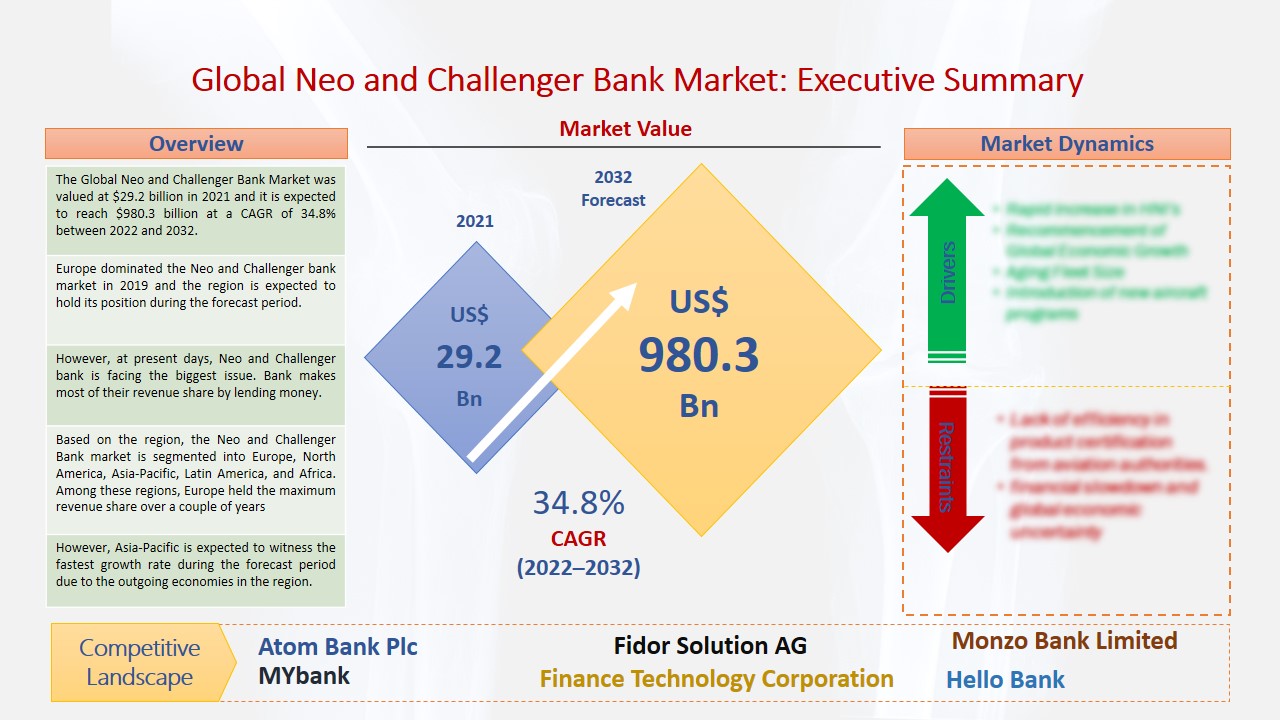

The Global Neo and Challenger Bank Market was valued at $29.2 billion in 2021 and it is expected to reach $980.3 billion at a CAGR of 34.8% between 2022 and 2032. Neo and Challenger bank provides various bank services to individual customers and businesses. These banks do the majority of their businesses through online platforms. The main difference between these two banks is that neo banks do not have physical branches, while Challenger bank has various physical branches across the globe. However, both banks are different from traditional banks.

Europe dominated the Neo and Challenger bank market in 2019 and the region is expected to hold its position during the forecast period.

Neo and Challenger bank provide services such as opening and operating bank accounts, payment and transfers of money, lending, mobile banking, remittance solutions, and alternative procedures for evaluating creditworthiness. These banks are providing such services to both small and medium enterprises and the consumers of developing countries. However, traditional banks are offering higher interest rates to their customers. Neobank also known as a digital-only bank has provided low-cost services to its customers which are expected to drive the market growth over the forecast period. In March 2020, during the lockdown period of COVID-19, Neo banks and Challenger banks dropped by nearly 90 percent compared to a 60 percent drop-off for traditional banks due to complete lockdowns.

Source: SAI Research

However, at present days, Neo and Challenger bank is facing the biggest issue. Bank makes most of their revenue share by lending money. Instead of doing so, these banks are only relying on deposits, overdrafts, and ancillary services which are low-cost foreign transaction services. Therefore, they do not make most of the profit, thus their income streams are under threat. Since international travel has stopped for a while due to the COVID crisis, interest rates hardly made money on transaction accounts. Based on services, the global Neo and Challenger bank is segmented into loans, mobile banking, checking and savings account, payment, and money transfer. The loans segment is dominated the Neo and Challenger Bank market over the last few years and it is expected to dominate the market through the forecast period.

Based on the region, the Neo and Challenger Bank market is segmented into Europe, North America, Asia-Pacific, Latin America, and Africa. Among these regions, Europe held the maximum revenue share over a couple of years and the region is anticipated to witness the largest market growth during the forecast period from 2022 to 2032. In the European region, Neo and Challenger bank provides offers and services to their customers which are nearly four times cheaper than traditional banks. Neo and Challenger banks are mainly focusing on the minor and professionals enterprises which are looking for digitalized banking in the market across the region. However, few British companies such as Atom Bank and Tandem Bank are targeting travelers by offering them multicurrency payment cards with low-currency conversion remuneration. However, Asia-Pacific is expected to witness the fastest growth rate during the forecast period due to the outgoing economies in the region. Easy and convenient bank services are the major factors that are driving the growth of the market across the countries such as India, China, Japan, and Indonesia among others.

The key players in the global Neo and Challenger Bank market are Atom Bank Plc (U.K), Fidor Solution AG (Germany), Monzo Bank Limited (U.K), MYbank (Malaysia), Number26 GmbH (Germany), Finance Technology Corporation (U.S), Tandem Bank (U.K), UBank Limited (South Africa), WeBank (China), Holvi Bank (Finland), Rocket Bank (Bangladesh), DigiBank (Singapore), Koho Bank (Canada), Hello Bank (Germany) among others.

Scope of the Report:

|

Report Coverage |

Details |

||

|

Base Year: |

2021 |

Market Size in 2021: |

USD 29.2 Billion |

|

Historical Data for: |

2019, 2020 and 2021 |

Forecast Period: |

2022 to 2032 |

|

Forecast Period 2022 to 2032 CAGR: |

34.8% |

2032 Value Projection: |

USD 980.3 Billion |

|

Segments covered: |

By Services - Loans, Mobile Banking, Checking and Savings Account, Payment and Money Transfer & Others. By End-User - Personal, Business. |

||

|

Geographies covered: |

North America - U.S, Canada, Mexico Europe - Germany, France, Italy, U.K, Russia, Rest of Europe Countries Asia-Pacific -India, China, Japan, South Korea, North Korea, Rest of Asian Countries LAMEA - Brazil, Saudi Arabia, Rest of LAMEA |

||

|

Companies covered: |

Atom Bank Plc (U.K), Fidor Solution AG (Germany), Monzo Bank Limited (U.K), MYbank (Malaysia), Number26 GmbH (Germany), Finance Technology Corporation (U.S), Tandem Bank (U.K), UBank Limited (South Africa), WeBank (China), Holvi Bank (Finland), Rocket Bank (Bangladesh), DigiBank (Singapore), Koho Bank (Canada), Hello Bank (Germany) among others. |

||

The Neo and Challenger Bank Market Has Been Segmented Into:

The Neo and Challenger Bank Market – By Services:

- Loans

- Mobile Banking

- Checking and Savings Account

- Payment and Money Transfer

- And Others

The Neo and Challenger Bank Market – By End-User:

- Personal

- Business

The Neo and Challenger Bank Market – By Region Type:

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe Countries

Asia-Pacific

- India

- China

- Japan

- South Korea

- North Korea

- Rest of Asian Countries

LAMEA

- Brazil

- Saudi Arabia

- Rest of LAMEA

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing