U.S. Cashfree Payments Market, (By Payment Type: Digital Currencies, Bank Cards, and Digital Wallets, Net Banking, Points of Sales & Others. By Enterprise Type: Small and Medium Enterprises, Large Enterprises. By End-User Type: BFSI, Healthcare, Media and Entertainment, Retail and E-Commerce, Transportation & Others. By Geography – U.S.) | Industry Size, Share, Research Reports, 2022-2032

Report Type : Syndicate Report

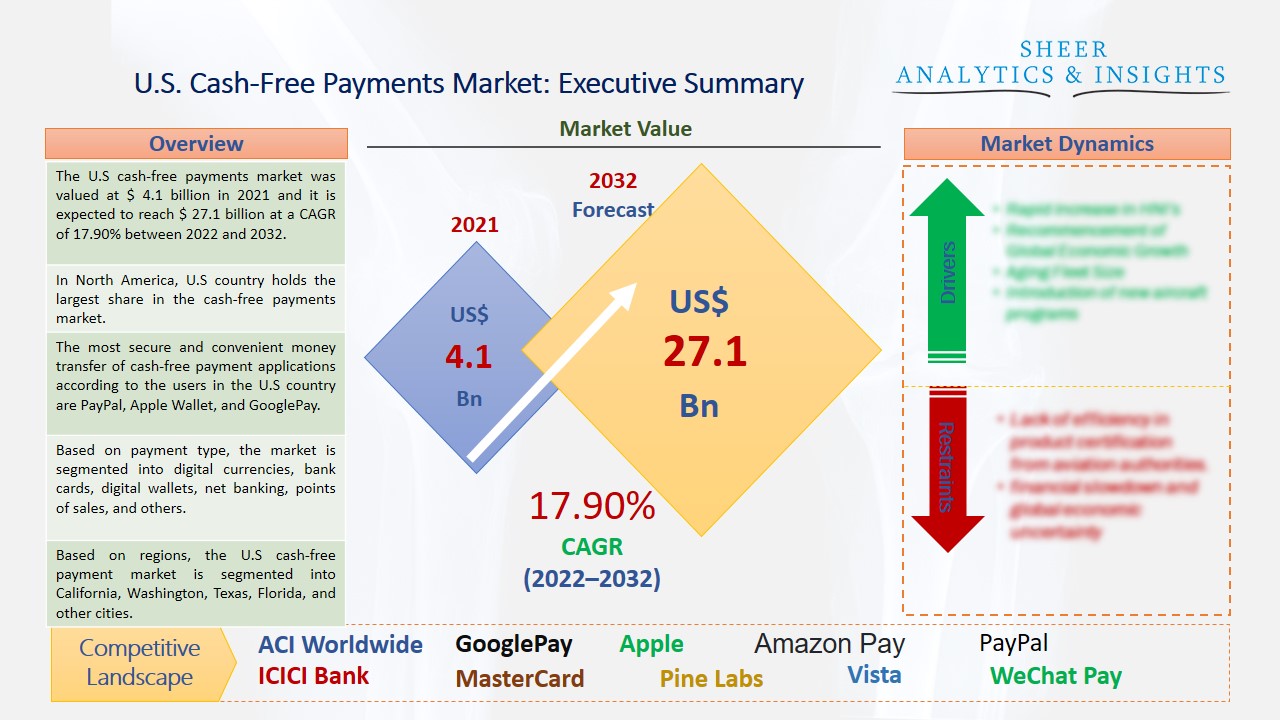

The U.S cash-free payments market was valued at $ 4.1 billion in 2021 and it is expected to reach $ 27.1 billion at a CAGR of 17.90% between 2022 and 2032. Cash-free payments also known as digital payment systems have become an attractive and convenient alternative to cash transactions in recent years in the U.S country. The majority of customers use their mobile phones to purchase any product from online shopping platforms.

In North America, U.S country holds the largest share in the cash-free payments market.

The most secure and convenient money transfer of cash-free payment applications according to the users in the U.S country are PayPal, Apple Wallet, and GooglePay. Due to the rising usage of mobile phones and online payment applications, and the increasing adoption of advanced technologies which have made cashless payment platforms safe and secure, the U.S cash-free payments market is expected to have significant growth during the forecast period. Hence, consumers are turning to digital payments in increasing numbers but are not clear whether all recent behavior shifts would prove to be permanent. However, the U.S government is taking the initiative to introduce cash-free payment solutions by implanting new strategies to draw the attention of more customers across the country. E-commerce sales in the country are also growing with the improvement of the digital payment experience. This is expected to further reflect consumers' rising comfort with online shopping and the increasing use of mobile and hand-held devices. In addition, improved 5G connectivity helps digital payment service providers to more effectively implement fraud prevention measures. These rising factors are estimated to drive the U.S cash-free payment market throughout the upcoming years.

Source: SAI Research

Based on payment type, the market is segmented into digital currencies, bank cards, digital wallets, net banking, points of sales, and others. The points of the sales segment are estimated to hold the maximum share due to its increasing usage in retail stores for processing transactions. These systems offer benefits such as fast checkout options, customized experiences for U.S customers, and other several payment methods. Based on the enterprise, the market is categorized into small, medium, and large enterprises. The large enterprise segment is expected to dominate and support the cash-free market in the U.S country. Due to the rising sales of e-retailers in online shopping websites and malls, this segment is projected to drive market growth. Based on user type, the cash-free payment market is segmented into healthcare, BFSI, media and entertainment, retail and e-commerce, transportation, and others. The BFSI segment is accounted to hold the largest share in the market. The growing demand for digital payment platforms for cross-border and domestic transactions is supporting banks to adopt digital payment solutions.

Based on regions, the U.S cash-free payment market is segmented into California, Washington, Texas, Florida, and other cities. Major cities are expected to witness significant growth due to the rising usage of smartphones and online payment applications. Retail stores and services across the major cities are rapidly adopting and integrating mobile payment applications such as PayPal, Samsung Pay, Apple Pay, Google Pay, and other digital payment options. Moreover, due to changing lifestyles, daily commerce, and rapid growth in online retailing, major cities in the U.S are expected to drive the growth of the cash-free payment market during the forecast period. Supermarkets, restaurants, and stores are popular places for cash-free mobile payments, as consumers are more prone to use smartphones and their applications in digital payment mode. Therefore these rising factors are also anticipated to drive the growth of the market across the U.S country.

A U.S-based Company named ACI Worldwide has launched value-added services with built-in open banking capabilities, which offer contactless and secure QR code payments, including merchant-initiated payments using dynamic QR codes. It has also enabled digital payment overlay services for liquidity management, ERP integration, and invoice and accounts payable management, P2P payments, account to account payments, PoS, ePoS, and more through ACI’s partnership with Mindgate. This year, Apple Inc has launched Tap to pay options on iPhone, through which U.S merchants will be able to accept Apple Pay and other cash-free payments by using iPhone and partner-enabled iOS applications. This new capability will empower a large number of merchants across the U.S country, from various-sized business retailers using their iPhones to use it seamlessly and safely receive online payment contactless credit and debit cards, a simple tap on their iPhones among other digital wallets. U.S-based Company Alphabet Inc has launched a new digital wallet with a slew of amazing features and its expansion plans are all set to transform the payments in the U.S country. Moreover, MasterCard and Verizon together have teamed up to launch new 5G contactless payments for their consumers and medium-sized businesses. They are focusing on digitalizing and disrupting global consumer spending at retailers and other merchants. Wex Company launches Flume, a digital payment platform designed to enable fast, transparent payments for small and medium businesses. This is a unique digital wallet specifically designed to support 30 million users across the U.S country. Therefore, these new launches are projected to drive the growth of the U.S cash-free payment market in the upcoming years.

According to the study, key players such as ACI Worldwide (U.S), Aurus Inc (India), Apple Inc (U.S), Alphabet Inc (U.S), Amazon Pay (U.S), Adyen (Netherlands), Alipay (China), BillDesk (India), BharatPe (India), Global Payments Inc (U.S), ICICI Bank (India), Instamojo (India), MasterCard (U.S), Novatti Group (Australia), One97 Communications (India), PayPal Holdings (Inc), Pine Labs (India), RazorPay (India), Stripe (U.S), Sage Pay Europe Limited (U.K), Vista Equity Partners (U.S), Visa Inc (U.S), WeChat Pay (China), WEX Inc (U.S), Walmart (U.S), among others are leading the U.S cash-free payments market.

Scope of the Report:

|

Report Coverage |

Details |

| Market Size in 2021 | US$ 4.1 billion |

| Market Volume Projection by 2032 | US$ 27.1 billion |

| Forecast Period 2022 to 2032 CAGR | 17.9% |

| Base Year: | 2021 |

| Historical Data | 2019, 2020 and 2021 |

| Forecast Period | 2022 to 2032 |

| Segments covered |

By Payment Type: Digital Currencies, Bank Cards, Digital Wallets, Net Banking, Points of Sales & Others By Enterprise Type: Small and Medium Enterprises, Large Enterprises By End-User Type: BFSI, Healthcare, Media and Entertainment, Retail and E-Commerce, Transportation & Others |

| Geographies covered |

United States: California,Washington, Texas, Florida & Others |

| Companies covered | ACI Worldwide (U.S), Aurus Inc (India), Apple Inc (India), Alphabet Inc (U.S), Amazon Pay (U.S), Adyen (Netherlands), Alipay (China), BillDesk (India), BharatPe (India), Global Payments Inc (U.S), Huawei Investment and Holdings (China), ICICI Bank (India), Instamojo (India), JD.Com (China), MasterCard (U.S), Novatti Group (Australia), One97 Communications (India), PayPal Holdings (Inc), Pine Labs (India), RazorPay (India), Stripe (U.S), Sage Pay Europe Limited (U.K), UnionPay (China), Vista Equity Partners (U.S), Visa Inc (U.S), WeChat Pay (China), WEX Inc (U.S), Walmart (U.S), among others |

U.S Cashfree Payments Market Has Been Segmented Into:

U.S Cashfree Payments Market – by Payment Type:

- Digital Currencies

- Bank Cards

- Digital Wallets

- Net Banking

- Points of Sales

- Others

U.S Cashfree Payments Market – by Enterprise Type:

- Small and Medium Enterprises

- Large Enterprises

U.S Cashfree Payments Market – by End-User Type:

- BFSI

- Healthcare

- Media and Entertainment

- Retail and E-Commerce

- Transportation

- Others

U.S Cashfree Payments Market – by Regions:

united states

- California

- Washington

- Texas

- Florida

- Others

Buy Chapters or Sections

Customization options available to meet your custom research requirements :

- Request a part of this report

- Get geography specific report

- Request historical analysis

- Check out special discounted pricing